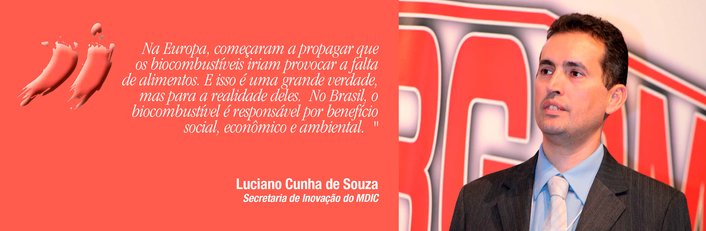

Luciano Cunha de Souza

Innovation Secretariat of MDIC

Op-AA-30

The answers, as usual, will come with the interest of the market

The challenge of energy planning is a complex issue. We must warrant that there will be energy for everybody, and food as well. Obviously, energy and food have different levels of importance, but they are quite close to each other on the scale. Both are necessities of our people. These issues should never conflict between each other. What role does business play in this scenario? Simply said: does business have the mission to produce something and make a profit? On the other hand, the role of government is to balance the demands of all stakeholders.

The business that makes a profit will be encouraged to invest, to generate jobs, employees will be motivated to buy, thus assuring that the system is up and running. This is a well-known issue. Why should we invest in biofuels? Of the many reasons, I highlight three: Climate change, energy insecurity and growing difficulties in oil production.

Brazil began the “Proálcool” program because of energy insecurity and difficulty in producing oil, which, over the years, brought about the current biofuels scenario. Nowadays, we are en route to a new level, with the option of second generation biofuels. In fact, this is disturbing for many people. In Europe, a rumor is being spread that high biofuels production will result in food shortages. This is in fact reality – but it is their reality.

If they were to produce the biofuels needed for their reality, they would create a huge social problem, given their lack of land, water and

labor. In the case of Brazil, biofuels are responsible for a major social, economic and environmental benefit for the country.

EPE - Empresa de Pesquisa Energética (Environmental Research Company) has estimated that we have 140 billion tons of sugarcane bagasse in Brazilian plants, of which only 8% are used to produce electric power, meaning that we have almost 130 billion tons of bagasse, that does not need to be bought or transported, given that this homogenous, ready, prepared and available raw material, dry and of fine granulometry, is already in the plant.

UNICA has projected expectations on ethanol consumption in the U.S.A., based on ethanol from corn, cellulose and advanced ethanol. Considering that sugarcane ethanol has already been classified as advanced ethanol, we are faced with the opening of a gigantic market to supply to, if we assume we are going to grow again at a considerable pace.

Do we only want to be in the advanced ethanol market, or should we make use of this other market? In Europe, legislation is still not quite clear, given that each country is regulating its own environmental requirements, and the situation is still somewhat complex. It is, however, increasingly tending towards demand for cellulosic ethanol. This demand exists, it has been specified, and is foreseen in Europe’s regulatory mechanisms.

With respect to technology, a study by CGEE - Centro de Gestão e Estudos Estratégicos (Strategic Management and Study Center), based on a state-of-the-art plant, showed that expectations about industrial efficiency gains in current ethanol production processes are very modest, because we are already operating at this high level of technology.

Even so, we have a large number of plants still equipped with older technology, which stand to gain a lot from first generation ethanol when improving their processes. In the agricultural field, we have larger potential productivity gains than in industry, with the implementation of new varieties, genetic improvements, pesticides, handling procedures, i.e., a great number of initiatives that will allow more gains than just state-of-the-art industrial technology.

This is a major stimulus for second generation ethanol because, without adding even a single hectare, we will be able to produce a huge volume of ethanol. On the ethanol remuneration pyramid, in a descending order from the highest to the lowest sale price, we have alcohol used in cosmetics and pharmaceuticals, then in food, then in bioplastics and polymers, then in bulk chemicals and fuel, and then at the end of the scale in energy and heating.

The theory on the production of biofuels has existed for decades, and in fact the challenges are in developing the projects that allow the best economics. That is why the most advanced projects have been those focused on products with the highest aggregated value. Thus, what we must decide is in which segment to invest. We must think a little ahead.

For example, how will we deal with the electric car? Whether we are prepared or not, it will come. We are investing into research on practically everything related to agroenergy, both as related to ethanol and diesel. Historically, we have done this in a widespread manner.

Currently, we are much more focused, as is the case of Dedini, CTC, Novozymes, CTBE, Petrobras, Fapesp-Bioen, most of which focused on enzymatic hydrolysis, because this is what best fits our plants. Bagasse that already is in a plant will undergo a hydrolysis process and will return for fermentation or something like that.

The agroenergy industry is one that receives most R&D investment in Brazil.

When will we have advanced biofuels? This is an answer the market will give. For the time being, it is better to produce other products of higher aggregated value. At a given moment, gasoline may reach a price that will make the production of second generation ethanol feasible. Certainly this will be a market decision with an eye toward economic feasibility and return on the investments to be made.