Marcos Silveira Bernardes

Professor of Extractive Plant Vegetal Production at Esalq-USP

Op-AA-24

Penalty Kicker

In Brazil, politics is commented through soccer parables and this is what I shall do here. When I was a kid, the godson of our team’s coach was a specialized “penalty kicker”. Standing in the defense area, I watched the ruse to aggrandize the favorite: when the stars of the attacking team managed to score a penalty to their benefit, they were replaced by the godson, who could thus add another goal to his track record.

The adult world is full of such specialists who now target sugarcane, advocating fallacies. First is the internationalization of the sugarcane industry and acceptance of our ethanol abroad. Few people comment that these two facts are linked in a cause/effect relation for the simple reason that the former critic has become the business owner.

Proof of this is that when the American spoliation of Brazilian cotton was brought before the courts, sugarcane became the “enslaver of men”. It is said that “There are sugarcane varieties ... capable of increasing productivity by 40%” and that biotechnology is the solution for the industry. To oppose such statements I resort to Professor Cornelius de Wit, an unquestionable authority in mathematical modeling in agriculture.

In the text “Resource use analysis in agriculture: a struggle for interdisciplinarity, John Wiley, 1994” he evaluates crop yield and resource use efficiency based on two well known and accepted phenomena: declining marginal returns, which means that each step in incrementing productivity requires an increasingly higher availability of the production factor, and the law of the minimum, which sets forth that the crop’s yield is proportional to the availability of the most limiting factor.

I add the secular price decline, making profit tend to zero in open participation activities such as agriculture. This is a definitive fact, however little divulged, meaning that prices of agricultural products, in real terms, have been declining continuously for thousands of years. Prices decrease as productivity increases, making agriculture an activity comparable to a dogs’ race to bite one’s own tail.

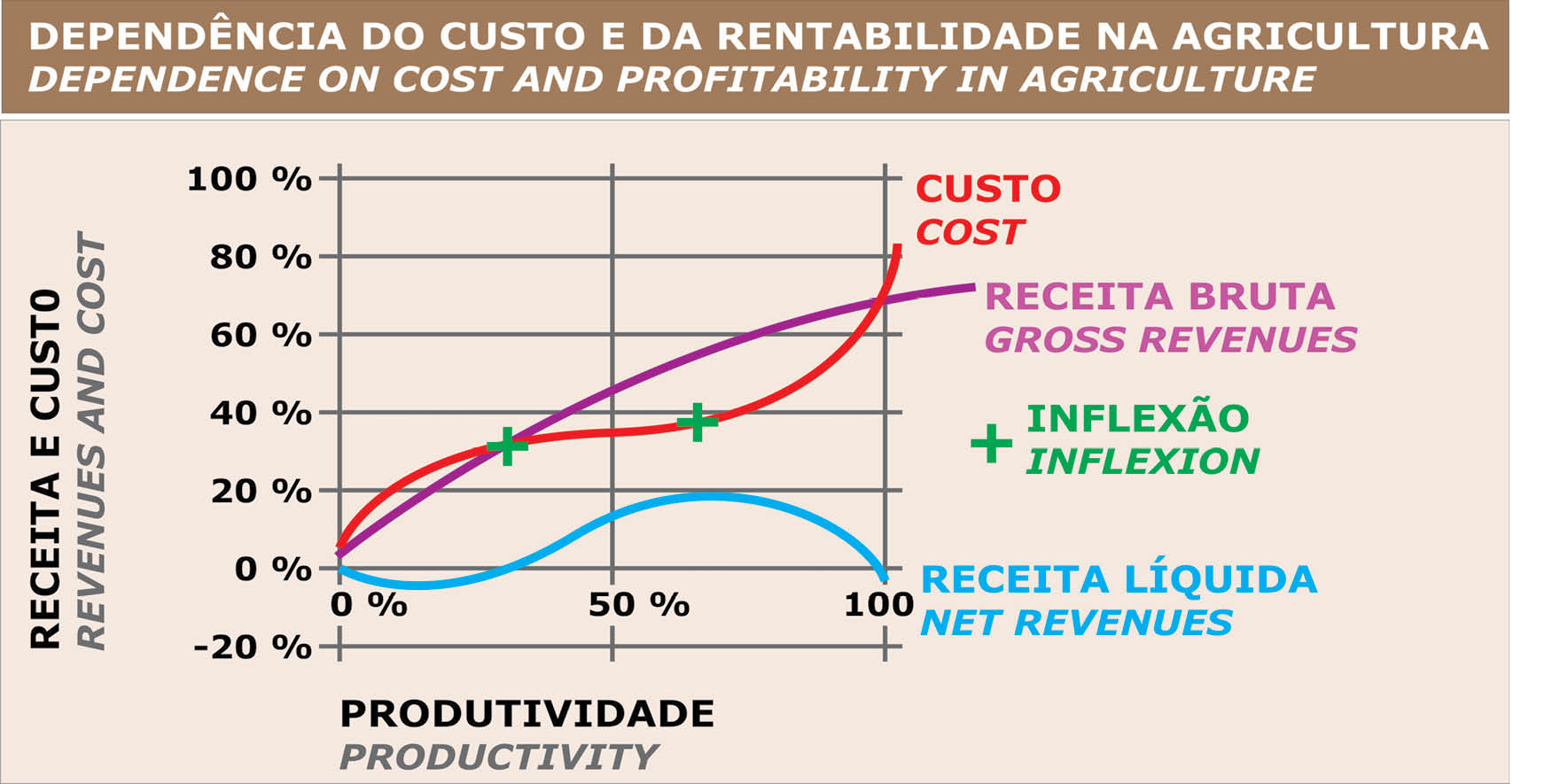

This reality is shown in the graph, in which productivity is on the horizontal axis and production and cost values are on the vertical axis, all related to potential. The blue curve shows production’s gross value.

The higher the productivity, the higher gross revenues, albeit decreasing as prices fall with high productivity. It is a fact that in all good harvests the price falls. The red curve shows the production cost trend. In the first phase, with less technology employed, cost increases without the proportional increase in productivity. Net revenues are negative. An example of this situation is a well planted sugarcane plantation that has no weed control.

The higher the productivity, the higher gross revenues, albeit decreasing as prices fall with high productivity. It is a fact that in all good harvests the price falls. The red curve shows the production cost trend. In the first phase, with less technology employed, cost increases without the proportional increase in productivity. Net revenues are negative. An example of this situation is a well planted sugarcane plantation that has no weed control.

In a second phase, with each technological contribution, one gains proportionately much more in productivity and net revenues increase too. The sugarcane producer struggles to stay in this phase, in which resources are more efficiently used and what matters are the results of integrated and multi-disciplinary research. All factors, optimally integrated in what one may call field handling, are what prevent the producer from incurring losses.

In the third phase, with the decreasing response in terms of productivity at each new contribution in tech-nology, net revenues decrease. The conformation of the curves in the graph may change depending on the adopted parameters, but it well shows what the Brazilian sugarcane producer feels. Given that the cost of capital is at least four times higher than growth in productivity in the industry and the exchange relation in the world market reduces by a half the value of our products, the situation gets worse every year.

Improvements in Brazilian sugarcane breeding comprise the world’s most efficient program. CTC, Ridesa and IAC and, more recently, CanaVialis, supported by more or less isolated initiatives of universities from the State of Alagoas to the State of Tocantins, have been conducting research in sugarcane for decades, including field handling, and direly suffered due to the lack of public funds to conduct their work.

They generated varieties that have the potential to produce much more than the propagated 40%. Some of the varieties could produce 300% more than the volume produced today. The producer does not handle them to that end because it is economically un-feasible.

Now that sugarcane is fashionable, institutions that never before thought of the product focus their interests on sources of income and sell the idea of biotechnology as the final solution. This is not what happened in citrus culture, which was only good enough to hand out awards, and with the sugarcane culture it will be no different. Biotechnology is a tool of little importance in view of all others.

There is no lab-generated photosynthesis rate for highly efficient sugarcane that can offset the Brazilian interest rate. There is no modification due to transgenesis of the culm composition that can offset the devaluation of the Brazilian product and the super-valuation of foreign capital resulting from the exchange rate. The industry must be managed and commanded by people committed to it, for instance, to the extent of more than 50% of personal income derived directly from sugarcane activities. Otherwise, without the star penalty kickers, we will probably have to import sugar from Haiti.