Haroldo José Torres da Silva

Gestor de Projetos do PECEGE

OpAA73

Resgate da eficiência agrícola e mitigação da ociosidade industrial

Coautoria: Peterson Felipe Arias Santos, Analista econômico do Pecege

A introdução dos veículos flex-fuel no mercado brasileiro, em 2003, representou um importante incentivo ao investimento e à expansão da capacidade instalada do setor sucroenergético no País. O grande sucesso desse tipo de motorização é evidenciado, por exemplo, no fato de que, no primeiro semestre de 2022, dos 853.126 licenciamentos, 81,8% dos veículos eram flex-fuel.

A possibilidade de livre substituição entre etanol e gasolina criou, do lado da demanda, uma dependência direta do preço do primeiro para com o preço da segunda. Do lado da oferta, por seu turno, o grande mercado potencial por etanol incentivou a criação de novas plantas industriais, inclusive pela redução do risco antes existente diante da dependência quase exclusiva para com o mercado global de açúcar.

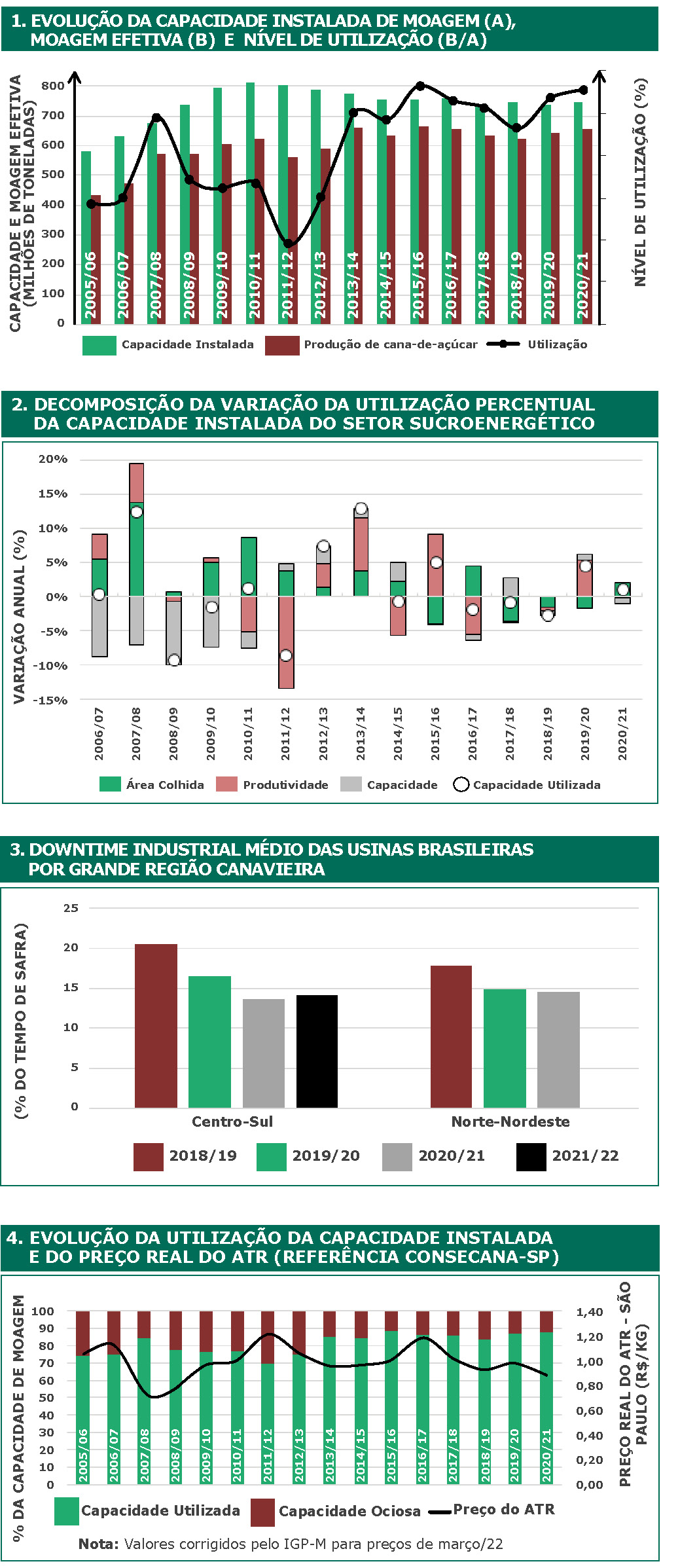

Considerando a evolução dos investimentos no setor no longo prazo, a Figura 1 apresenta a evolução da capacidade instalada de moagem de cana-de-açúcar no Brasil, desde a safra 05/06, bem como a produção efetiva de cana e o nível de utilização, compreendido como a razão entre ambas.

Considerando a evolução dos investimentos no setor no longo prazo, a Figura 1 apresenta a evolução da capacidade instalada de moagem de cana-de-açúcar no Brasil, desde a safra 05/06, bem como a produção efetiva de cana e o nível de utilização, compreendido como a razão entre ambas. A capacidade de moagem de cana-de-açúcar atingiu um pico na safra 10/11, caindo progressivamente na sequência, em função do fechamento de algumas usinas, porém se mantendo relativamente constante a partir do ciclo 14/15. A ociosidade na indústria teve seu apogeu na safra 11/12, proximamente ao pico de capacidade instalada, tal que o Nível de Utilização da Capacidade Instalada (NUCI) teria ficado abaixo de 70%. Similarmente à capacidade instalada em si, o nível de utilização teria apresentado maior estabilidade entre as safras 13/14 e 20/21, oscilando entre 83% e 88%.

A Figura 2 apresenta a decomposição da variação do NUCI da indústria sucroenergética, permitindo, assim, observar a contribuição relativa da produtividade, a área colhida e o aumento da capacidade de moagem no aumento ou na redução da ociosidade da indústria.

Após a introdução dos veículos flex-fuel, o aumento dos investimentos em capacidade industrial não foi acompanhado por ganhos de produtividade e de área colhida na mesma proporção, resultando em aumento da ociosidade, conforme evidenciado pela Figura 2. Na década de 2010, em especial, a partir de 2015, a combinação de redução da área colhida com estagnação da produtividade agrícola foi fundamental para que a ociosidade da indústria permanecesse, mesmo com o desinvestimento observado. Nas safras 21/22 e 22/23, o cenário apresentado na Figura 2 tende a permanecer na medida em que 1) a produtividade agrícola foi reduzida devido às adversidades climáticas e 2) os elevados preços de grãos – particularmente a combinação de soja e milho – têm atraído produtores independentes, que acabam por migrar de cultura no momento de reforma dos canaviais.

Além do hiato existente entre a capacidade potencial de processamento e a moagem efetiva de cana-de-açúcar, outro aspecto relevante nesse setor diz respeito ao downtime industrial. Ele equivale ao tempo em que a indústria fica parada devido à falta de matéria-prima, indisponibilidade climática ou problemas na própria planta industrial, refletindo o tempo de inatividade ou indisponibilidades dos equipamentos da planta industrial. Esse aspecto pode ser observado na Figura 3.

É importante ressaltar que o downtime industrial corresponde apenas ao período parado durante o período de safra e não é influenciado pela duração da safra em si.

Uma hipotética usina que possua 5.000 horas de safra e permaneça parada por 500 horas terá 10% de downtime; da mesma maneira, caso no ciclo seguinte, em que o tempo de safra se reduza para 4.000 horas, e a usina permaneça parada por 400 horas, então seu downtime ficará constante. Nesse sentido, é interessante observar que as safras 18/19, 19/20 e 20/21, nas duas grandes regiões canavieiras, apresentaram redução contínua do downtime industrial.

A permanência de uma elevada ociosidade na indústria tem impactos diretos sobre os custos unitários de produção, uma vez que existe elevada representatividade de custos fixos que acabam não sendo diluídos, pressionando as margens da atividade. As seguidas safras consideradas “curtas” implicam entressafras mais longas e necessidade de readequar os esquemas de trabalho nas usinas, de modo a incorporarem longas entressafras.

Por fim, é necessário reforçar que a ociosidade ora presente no setor sucroenergético soma-se à pouca evolução, em termos reais, dos preços dos produtos do setor no longo prazo, conforme encontra-se ilustrado na Figura 4.

Dessa forma, a despeito de picos relativamente cíclicos, o preço real do ATR – representativo da evolução do preço dos produtos do setor – permaneceu relativamente constante no longo prazo.

Considerando o atual nível de ociosidade da indústria de cana-de-açúcar, não se vislumbram, no curto prazo, oportunidades para expansão do parque de açúcar e etanol no País, sendo reduzida a probabilidade de crescimento via greenfields (novas usinas de açúcar e etanol de primeira geração – E1G). É possível um incremento de cerca de 13,9% da moagem de cana-de-açúcar no País – média do nível de ociosidade entre 2016 e 2015 –, sem implicar aumento de capacidade instalada (ou de processamento).

No curto prazo, o setor sucroenergético brasileiro tem um desafio para o seu crescimento: destravar a produtividade agrícola da cana-de-açúcar. Os ganhos de produtividade são necessários para catalisar a expansão da oferta de açúcar e etanol pelo País, implicando redução de custos e ganhos de eficiência.