Raul Gabriel Beer

Advisor for Mergers and Acquisitions

Op-AA-23

Sugarcane ethanol is already reality in multinacional companies strategy

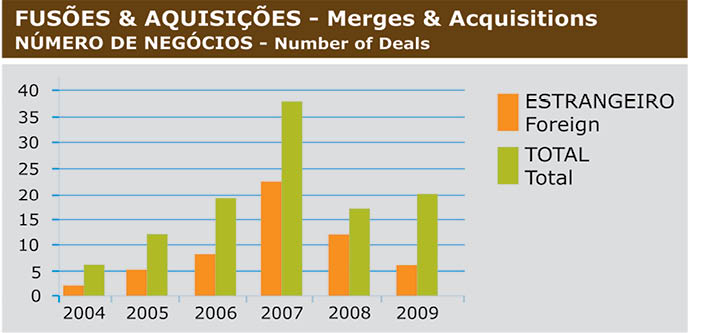

Some years ago, most Brazilian sugar and ethanol mills were Brazilian owned. Important exceptions were the Dreyfus and Tereos groups, both of France. Currently, estimates are that in 2010 foreign companies will represent about 20% of crushed sugarcane in the Center-South of Brazil. According to PricewaterhouseCoopers, half the 112 company mergers and acquisitions that took place in the industry in the past six years had foreign companies as buyers.

Since 2000, sugarcane ceased to be just another input in sugar production to become an essential raw material in the energy matrix. Some of the original opponents of ethanol understood that it was more convenient to participate in this market now and take up important positions, than to continue fighting it.

This opened the market to global companies in agribusiness, energy, petrochemical and even the logistics industries, which became interested in agribusiness and began seeking participation in all links of the ethanol production chain in Brazil. But, not only them: private equity funds, important companies of some emerging countries and also new ventures in the biotechnology industry.

The financial crisis in 2008 rendered some projects unfeasible, in cases when the rate of return depended on higher prices and created difficulties for others that still needed funding. There were also cases of losses caused by the inadequate use of financial derivatives. All this encouraged consolidation and facilitated acquisitions in the industry.

In recent years, the Dreyfus Group, a traditional commodities trader, increased its participation in the industry and its biggest recent move was the acquisition of Santelisa Vale. Bunge, today the world’s third largest sugar exporter, among others, acquired the control of Moema. ADM entered the market in partnership with the Cabrera Group, belonging to the former minister of agriculture, and, for the time being, follows a greenfield growth strategy.

What calls one’s attention, however, is that ADM is one of the largest producers in the world of ethanol obtained from corn. British Petroleum controls Tropical BioEnergia and has ambitious plans for this market. There are also rumors that multinational companies are wrangling over two mills belonging to a Brazilian group in financial trouble.

At the same time, some Brazilian companies with the vocation and power to act as consolidation agents stood out, making acquisitions and developing new greenhouse projects. One should notice, however, that some of these Brazilian companies have, or soon will have, significant foreign participation in their capital.

Cosan S.A is controlled by Cosan Ltd., a company owned by Brazilians, but with shares traded in the North American market. Cosan has strongly acted as a consolidator of mills, but it also focused on expanding its presence in other links of the chain.

Cosan S.A is controlled by Cosan Ltd., a company owned by Brazilians, but with shares traded in the North American market. Cosan has strongly acted as a consolidator of mills, but it also focused on expanding its presence in other links of the chain.

In the event that the recently announced transaction with Shell is confirmed, only a little more than half the “New Cosan” deal, which will then have local and for-eign controlling capital, will continue to have activities related to the crushing of sugarcane and the production of sugar and ethanol. Furthermore, by consolidating the assets of Esso and Shell, the company will become the third largest fuel retail distributor in Brazil.

This agreement results in economies of scale and synergies in the distribution operation, but, more importantly, it makes feasible Shell’s access to the market and production technology of sugarcane ethanol, while allowing Cosan to more quickly advance in the direction of second generation ethanol.

Similarly, ETH, controlled by Odebrecht, has a 33% participation of Japanese company Sojitz Corporation, a multinational company with activities in the commercialization of commodities. In the event that the acquisition of Brenco is confirmed, probably some additional foreign partners of this company may join up with Sojitz as foreign shareholders in the “new ETH”.

This is the new world of the mills, which could not ignore globalization. Sugarcane ethanol is already reality in the strategy of multinational companies, and this helps to overcome resistance to the product in other markets, refeeding their interest. Brazilian companies grow and consolidate the market and are expected to increase their international activities, while counting on foreign capital. In this globalized world, with strong companies – Brazilian and foreign – the good and old “alcohol” sold at Brazilian fuel stations definitively changed its name to ethanol.