Emmanuel Desplechin

Chief Representative in the European Union of the Brazilian Sugarcane Industry Association - UNICA

Op-AA-21

Market Access: Global challenges for ethanol

The need to foster energy security and mitigate climate change has sparked interest for biofuels among consumers and policy makers around the globe, conscious of the contribution biofuels could make in reconciling these two ambitious objectives. Policies to incorporate ethanol have therefore spread, in particular in the United States, with the Renewable Fuel Standard, and in the European Union with the adoption of the Renewable Energy Sources Directive, meaning that more ethanol will need to be traded if renewable energy targets are to be achieved.

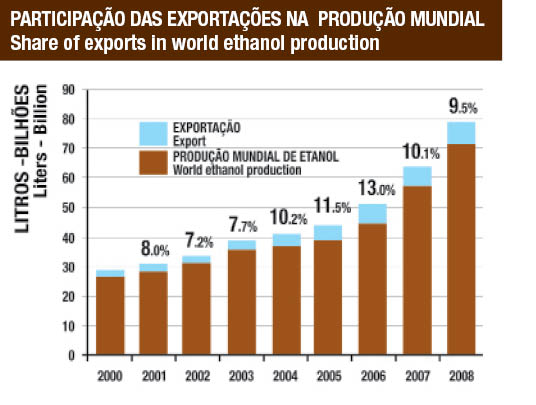

Nonetheless, not all policies are mandatory, making for an extremely volatile market, and different barriers to trade, be they tariff or non-tariff barriers, and explain why the proportion of ethanol exports in the world ethanol production remains fairly limited, with around 10% of the world production being traded, a proportion that remains constant over the years. This article presents the challenges to overcome to lift existing barriers and prevent future barriers from flourishing in the near future.

Tariff anomalies as the historical barrier to trade: In the US, the Renewable Fuel Standard mandates the consumption of 136 billion liters of ethanol by 2022, from 34 billion in 2008. A specific category will be introduced in 2010, so-called ‘advanced non-cellulosic ethanol’ for ethanol not made of corn, which achieves at least a 50% reduction in GHG emissions compared to petroleum, a requirement already fulfilled by sugarcane ethanol.

Achieving the ambitious US objectives without further opening the market will prove difficult. However, today the penetration of imports is limited because of the tariff duties on imported ethanol: a 2.5% ad valorem + US$ 0.54 per gallon when intended for fuel use, a tax that no longer matches the US$0.45 per gallon tax credit it was meant to offset.

Exports through the Caribbean Basin Initiative are possible at reduced duty but attract corresponding logistics costs, and limited dehydration capacities in the area and opportunities for direct shipment (e.g. oil price surges) explain why in 2008 most Brazilian exports to the US took the direct route and paid the tariff. The European Union appears as a promising market for ethanol exporting countries.

Brazilian exports to the European bloc have increased steadily over the last years, but volumes are much more limited. An important step was made by the European Union in December 2008 with the adoption of the Renewable Energy Sources Directives, which provides for 10% of the energy used in transport to come from renewables by 2020.

Although no dedicated quota was allocated to specific energy sources, most of this 10% is expected to come from liquid biofuels, making for a market estimated at 14 billion liters for fuel ethanol. But, as is the case for the US, the tariff duty represents a significant obstacle to market access, with a 19.2 €/hl duty levied on ethanol imports, independent of the end use.

In addition, the EU imports around 70% of its ethanol through preferential schemes, which effectively distort trade for exporting countries which do not enjoy similar preferential treatment. Despite the apparent optimism shown by the panelists of the Ethanol Summit session dedicated to the subject, in particular Victor do Prado, Deputy Head of Unit in the Office of the WTO Director General, who sees a potential for a tariff reduction in multilateral trade negotiations and a chance for the Doha round to succeed in 2010, tariffs remain difficult to lift or even reduce.

The inclusion of ethanol in the list of ‘environmental goods for development’ would certainly allow the elimination of tariff duties within the Doha round of negotiations, but criteria for the ‘environmental goods’ remain to be defined, and is strongly opposed by both the EU and the US for ethanol being an agricultural product, therefore not qualifying for this preferential status.

Although tariff barriers are the most commonly quoted sources of barriers to trade, other obstacles prevent the commoditization of ethanol. To name a few: the inconsistencies or lack of public policies, the absence of common standards for fuel ethanol, and sustainability issues, the latter becoming increasingly relevant, and which could govern the future of trade relations for fuel ethanol.

Although tariff barriers are the most commonly quoted sources of barriers to trade, other obstacles prevent the commoditization of ethanol. To name a few: the inconsistencies or lack of public policies, the absence of common standards for fuel ethanol, and sustainability issues, the latter becoming increasingly relevant, and which could govern the future of trade relations for fuel ethanol.

The flourishing of non-tariff barriers to trade: The so-called tripartite initiative, gathering the US, Brazil and the EU in a joint effort to harmonize standards for biofuels, is in a deadlock. Where the case of biodiesel seems not to cause any problem, little effort is made to harmonize standards for ethanol, leading to a technical barrier to trade. For example, the water content limit allowed in fuel ethanol differs in the three regions, and obliges the Brazilian production to an extra costly effort to meet the European standard, with no rationale for such restriction. The adoption of the RES Directive by the European Union includes a set of sustainability criteria for biofuels to count toward the 10% target and be eligible for financial support.

These criteria include minimum greenhouse gas savings compared to fossil fuels, but also restrictions in land use for crops for biofuels. These have the potential to become the future most important barrier to trade for fuel ethanol, rendering tariff issues even secondary, as non-compliance or the absence of proof of compliance may well mean the denial to access foreign markets, independent of duties paid.

Although the requirements set in the Directive apply equally to domestic and imported biofuels, the requirements are much more demanding for tropical and sub-tropical countries, where the majority of the world’s biodiversity is located. Some criteria remain to be defined, which affect to a larger extent production in third countries, and the inclusion of non-science based arguments to limit the expansion of crops for biofuels, namely Indirect Land Use Change, also represents a threat for future trade relations.

Jane Earley, of the Earley & White Consulting Group, reported that sustainability criteria for biofuels could be challenged at the World Trade Organization if either designed as being discriminatory or unrelated to the product characteristics. In particular the use of ‘uncertifiable’ obligations regarding concepts difficult to capture (the case of so called ‘High Conservation Value Land’ or ‘Indirect Land Use Change’) is likely to be problematic.

However, standards applied by the private sector, as the case of the ‘Verified Sustainable Ethanol’ system developed by SEKAB in Sweden with its Brazilian providers, would not contravene existing WTO rules. Conclusions: Among the factors contributing to the commoditization of ethanol are the adoption of targets for biofuels’ use in an increasing number of developed and developing countries, the intervention of global firms from a wide range of sectors in the biofuels industry, and the need to achieve countries’ emissions reduction targets to mitigate climate change.

But tariffs and trade distorting measures, far for being lifted, persist. Recent legislative developments could render the tariff question irrelevant, if other barriers to trade were erected. Common standards need adopting as a first step, and the proliferation of sustainability requirements should be avoided. Having said that, the future will tell us if sustainability criteria will hamper the development of a global market or lay the ground for its consolidation, by fostering confidence among consumers.

In the meantime, work needs doing in repealing myths, and better informing on ethanol benefits to mitigate climate change. In trade relations, policies should better complement production and consumption, and seek the elimination of distorting support mechanisms. Finally, in relation to interested third countries, technical and scientific co-operation should be pursued. UNICA, through its headquarters and representation offices in Washington and Brussels, will continue advocating for the fall of barriers to trade, in order to ensure that the potential sugarcane ethanol offers to mitigate climate change and foster energy security is maximized.