Eduardo Leão de Sousa

Executive Director of the Brazilian Sugarcane Industry Association (UNICA)

Op-AA-21

The sugar-energy industry and the challenges of the carbon market

This article reflects the views of the authors and partially consolidates the debates held in the panel that took place at the Ethanol Summit, which was attended by three experts on the theme: Gylvan Meira - visiting researcher at the Advanced Studies Institute of the University of São Paulo, Divaldo Rezende - of Cantor CO2e Brasil, and Luiza Hirata - of SustainCapital.

The market instrument that goes by the name of Clean Development Mechanism (CDM) is the best known tool, both in the business community and by the public in general, for promoting clean technologies in developing countries. In Brazil, the sugar-energy industry was innovative in utilizing this instrument and is largely responsible for its development in the country.

However, although it is an ingenious and innovative step as a means to mitigate the effects of global warming, in reality the CDM has yet to fully compensate entrepreneurial initiatives that reduce greenhouse gas emissions. Thus, in this article, we will seek to identify some restrictions in using the CDM, show other potential opportunities for the sugar-energy industry and suggest a debate on the future of market mechanisms as a tool in fighting climate change in Brazil and the world.

The CDM was the means defined in the context of the Kyoto Protocol to promote greenhouse gas emission reductions globally, in an economically more efficient manner. It is a system based on compensations, which allows companies in developed countries to comply with their emission reduction targets as outlined in the Protocol, by promoting investments in low carbon intensity technologies in developing countries.

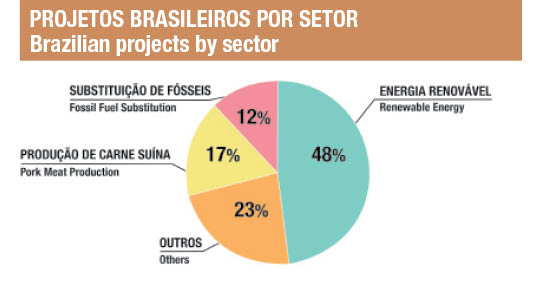

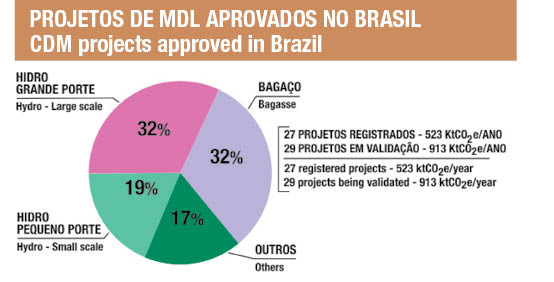

The CDM generates units of certified emission reductions (CERs) – the “carbon credits” – which can be purchased by companies in industrialized countries to comply with their emission reduction obligations. Brazil ranks third among all countries in the number of CDM projects, after China and India. About 50% of these projects are related to the generation of renewable energy, mainly hydroelectric and bioelectricity generating projects based on the incineration of sugarcane bagasse in high efficiency boilers. Co-generation is the main vector for obtaining carbon credits in the sugar-energy industry. Within the CDM, approximately 500,000 tons of CO2 carbon credit equivalents (CERs) are generated per year by Brazilian mills through co-generation.

The CDM generates units of certified emission reductions (CERs) – the “carbon credits” – which can be purchased by companies in industrialized countries to comply with their emission reduction obligations. Brazil ranks third among all countries in the number of CDM projects, after China and India. About 50% of these projects are related to the generation of renewable energy, mainly hydroelectric and bioelectricity generating projects based on the incineration of sugarcane bagasse in high efficiency boilers. Co-generation is the main vector for obtaining carbon credits in the sugar-energy industry. Within the CDM, approximately 500,000 tons of CO2 carbon credit equivalents (CERs) are generated per year by Brazilian mills through co-generation.

This figure is bound to triple if all projects in the validation process are approved. Thus, the sugarcane industry is one of the main industries in Brazil that uses the CDM as a financial tool for investments in low carbon technologies. The graphs show the distribution of CDM projects and those focused on renewable energy in Brazil. However, the possibilities of using carbon credits in the sugarcane industry are not restricted to co-generation.

Hence, it is an important and innovative instrument to generate market incentives for emission reductions. In reality, however, the results achieved with this mechanism have remained well below expectations, ineffective in bringing about a significant reduction in emissions on a global scale.

In fact, considering actually granted credits, the CDM only helped reduce 280 million tons of CO2e per year, which represents about 0.6% of global annual emissions, including emissions from soil usage. In the case of the sugar-energy industry, for example, it is worth noting that the production and consumption of ethanol, this industry’s main product, which has the highest mitigation potential, are currently not eligible.

Among the CDM’s main difficulties, one can highlight:

a. Additionality and baseline: Additionality means that the reduction in emissions brought about by the CDM must be additional with respect to what would have occurred had such initiatives not taken place (baseline). Since the baseline can change, innovative industries may be adversely affected for “taking the lead”, given that their initiatives would no longer be additional. Furthermore, countries with advanced environmental legislation could also be affected.

Initiatives regulated by national legislation are not deemed additional. Such problems partially explain why Brazil, a relatively low carbon intensity economy with advanced environmental legislation, ranks behind China and India in the number of CDM projects.

b. Elaboration of new projects and methodologies: The elaboration of new CDM methodologies and of so-called Project Concept Documents are costly, complicated and time-consuming processes. In practice, this renders small scale projects unfeasible, mainly if there is no previously approved methodology.

Furthermore, in several projects there are difficulties in determining credit ownership, given that it is difficult to set project limits (where a project begins and where it ends). For example, in a possible project for use of biofuel, who should receive the credits: the producer, consumer, or distributor?

c. Approval and monitoring procedures: Bureaucracy problems with such procedures generate high costs and uncertainties about the time period and about success in obtaining credits. CDM principles set forth that carbon credits must be needed to render a project financially feasible.

The problem is that, given the mentioned difficulties, the revenues associated with potential carbon credits can seldom be taken into consideration in a project’s financial planning.

d. Volatility of carbon markets: Finally, carbon markets are highly volatile, making financial planning difficult. There is also a lack of liquidity of credits generated by CDM projects.

The main objective of the regulated trade in carbon is to bring about reductions at lower marginal costs, in other words, wherever additional reductions are more cost efficient. However, most regulated markets, limit trading in credits resulting from CDM projects, depreciating their price. It is difficult to imagine, at least in the short term, that any agreement will be reached to minimize such difficulties.

The main objective of the regulated trade in carbon is to bring about reductions at lower marginal costs, in other words, wherever additional reductions are more cost efficient. However, most regulated markets, limit trading in credits resulting from CDM projects, depreciating their price. It is difficult to imagine, at least in the short term, that any agreement will be reached to minimize such difficulties.

However, one must point out that the CDM, notwithstanding its importance, is not the only mechanism that can benefit innovative projects and industries that promote low emission technologies. There are others. One such project is the voluntary market. It follows the same logic as the CDM, however, to a certain extent, simplifies some of its complexities.

Since there are no clearly defined rules by any regulating agent, as in the case of the CDM, it is the buyer who determines the requirements and asserts emission reduction compliance. However, the credibility of the achieved reductions directly impacts the market’s acceptance and the price of the generated credits. Thus, transparent processes, widely accepted methodologies and verifications by third parties are extremely important.

Some initiatives seldom contemplated by the CDM, such as forest projects, so rare in the regulated market, can more easily be accepted in the voluntary market. Furthermore, the existence of environmentally responsible projects and initiatives, which promote clean technologies and emission reductions, has been well accepted by financial markets and can significantly impact a company’s share prices.

In the case of non-listed companies and groups, private equity funds too have increasingly become interested in companies with robust initiatives in this area. Hence, these are important and promising examples of financial opportunities, still little exploited, in innovative areas such as the sugar-energy industry. In conclusion, the origin of most of the CDM’s methodological difficulties lies in the fact that to calculate emission reductions, this is done based on a hypothetical and variable-over-time baseline. Perhaps one should go back and consider the origins of carbon trading, which is exchanging emission licenses (cap and trade).

In this case, the baseline is pre-established. This fact greatly reduces the difficulties in defining additionality, reducing costs and uncertainties in the process of proving that reductions were achieved. It is possible to imagine the creation of a national system for exchanging emission licenses, allowing it to integrate with other international systems, even if this occurs outside the context of the Kyoto Protocol – or of any other future UNFCCC. Certainly there would be winners and losers.

The sugar-energy industry would no doubt be one of the potential beneficiaries. However, albeit an economically more efficient manner to fight climate change, such a model would also result in important competitive advantages for a number of Brazilian industries, mainly when international debates arise on possible trade barriers for products from countries that do not adopt similar models.