Luiz Carlos Corrêa Carvalho, Caio

Director of Canaplan Consultoria

Op-AA-29

A race against time

For the medium-term, one adopted the sugarcane cycle, and 10 years for the long-term. The most recent global crisis (2008) is the background of the scenario now inherent to sugarcane agribusiness. Its impacts are little by little being understood. For the Brazilian sugarcane industry, they came as a wave proper of a professional surfer. To predict the medium– and long-term requires knowledge about actual reality in the industry that has yet to experience the consequences of the most recent visit of the “black swan” (2008).

Offer and conditions:

1. Euphoria in the industry took place in 2006 and 2007, with major inversions in greenfield projects in the industry, in ethanol and in co-generation of electric power, in addition to the expansion of existing mills, along with strong growth of oil prices, bringing about intensive financial leverage in the industry. Planting on a large scale takes place, also in anticipation of the projects under analysis in the banks:

2. The mentioned years are characterized by low average prices in the industry, the valorization of the Real and actual increases in production costs. The consequence was the actual reduction in sugarcane plantations’ renewal, resulting in their aging and in declining agricultural productivity, further adversely affected by extreme climate phenomena (excessive rain in the 2009/10 harvest and expected

drought in 2010/11).

3. Accelerated consolidation of the industry, reducing expansion.

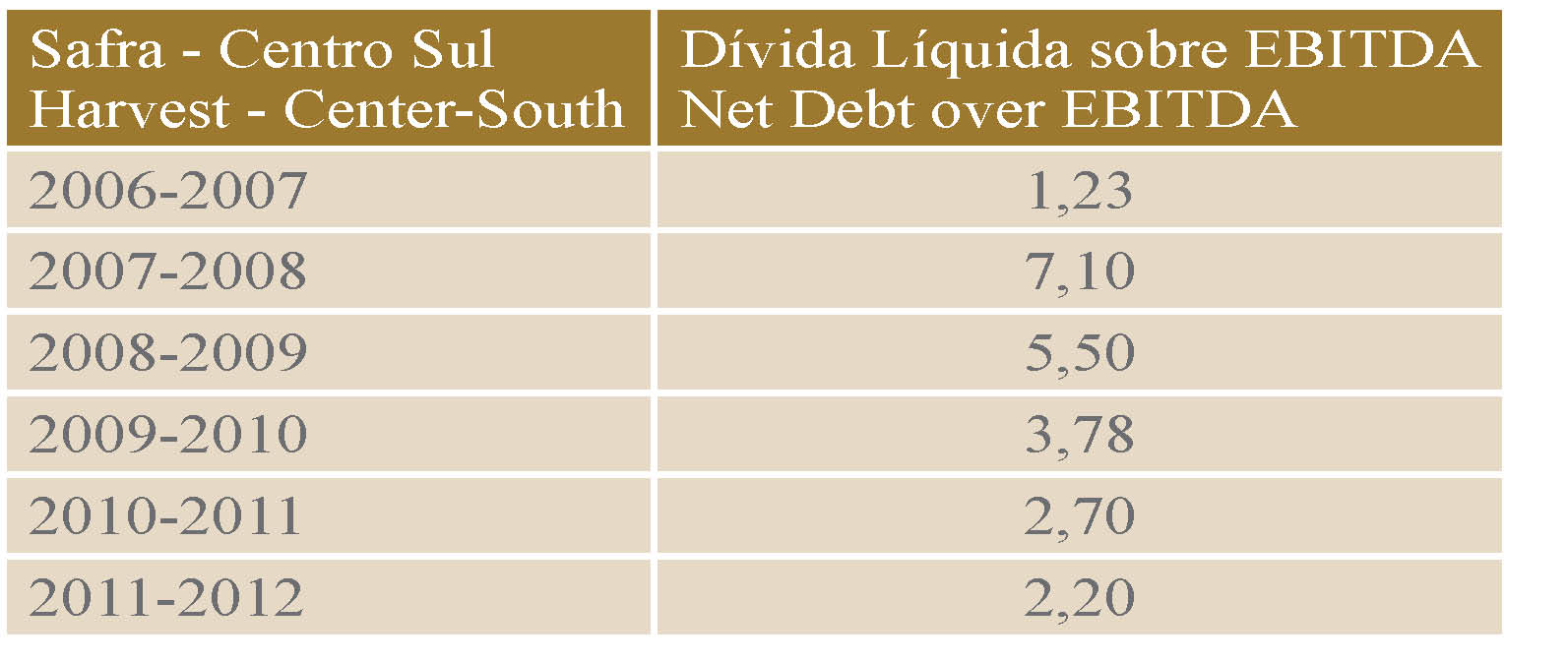

The reduction in debt was accompanied by a reduction in investments and technology applied in the fields and in the industrial sector, bringing about severe limitations to the supply of cane and the crushing capacity. The 2010/11 harvest was faced with a significant reduction in cane crushing capacity compared with initial expectations, creating natural anxiety with respect to the 2011/12 harvest.

The reduction in debt was accompanied by a reduction in investments and technology applied in the fields and in the industrial sector, bringing about severe limitations to the supply of cane and the crushing capacity. The 2010/11 harvest was faced with a significant reduction in cane crushing capacity compared with initial expectations, creating natural anxiety with respect to the 2011/12 harvest.

Whereas most people predicted a harvest of 570 million tons of sugarcane (Canaplan in April/11 predicted a floor capacity of 528 million, if problems were to arise), the outlook is that of a long-lasting low in sugarcane supply. The logic behind this vision of a low level supply is based on several essential parameters:

a. From 2005/06 to 2008/09, the annual growth rate of harvested areas went from 6 to 15% per year; between 2009/10 and 2011/12 it went from 6 to 2% per year.

b. The comparison of average agricultural productivity in recent harvests dropped from 91 – 92 tons of cane per hectare at the beginning of the harvests to 75 tons of cane per hectare in the 2011/12 harvest, with the weighted average age going from 3.14 years to 3.72 years between 2008 and 2011. A major effort to bring about renewal will result in actual growth picking up in 2015.

Demand and conditions: The last three harvests characterize a new phase, resulting from strong growth in demand for anhydrous ethanol (mixed with gasoline) and the so-called “C” gasoline (sourced at gas stations), while at the same time the sale of vehicles in the country increases strongly, with 85% to 90% of the cars running on both fuels (2 to 3 million new cars per year).

This results in a growing potential demand for hydrated ethanol, which, in view of the product’s stagnant supply, has resulted in the increased use of gasoline in flex-fuel cars. The increase in global sugar demand is expected to be at ~2.5% p.a., with this trend persisting in coming years.

Balance Supply/Demand:

1. Period 2011–2015: Constant and growing deficits of total available ethanol, between 28 and 55 million tons of TRS (Total Reducing Sugar) even with zero growth in sugar supply; this will result in the use of 1/3 of ethanol in flex-fuel cars (2/3 gasoline), causing high gasoline consumption. Average ethanol prices will be higher, as will average sugar price levels. One should also consider that costs will continue to rise.

In any case, gasoline prices “at the pump” will be key for higher or lower consumption of ethanol.

2. Period 2016–2020: Following the newly found equilibrium in sugarcane plantations in 2015, it will be essential to analyze the relation between investments in expansion projects of existing mills (brownfield projects) and those to be made in greenfield projects. It is certain that to meet the expected demand (which requires 12 to 15 new 3 million tons of crushed cane units/year) the investments will have to take place in the prior period (2011 – 2015).

This implies considering setting up new units in states that are farther away from ports and consumer centers. Efforts undertaken as concerning ethanol pipelines and railroads will necessarily be a part of such initiatives, to make them feasible.

Expectations:

1. One expects the Federal Government to implement policies (mainly through the BNDES) that entail funds for investment and costing, under acceptable conditions for the industry, with the government becoming aware as to agricultural risks in terms of production and inventory levels, and in the private sphere, with respect to the commitments to be incurred;

2. One expects the industry to reach equilibrium and to be generating productivity gains beginning in 2015, in a concentration process of the industry.

3. The in-country effects will be very important: the development or backward development of the economies of rich countries, the oil factor and commodities; the sense of global urgency as concerning the global warming issue; opening up of rich country markets;

4. Industry consolidation is expected to continue, with a strong increase of foreign capital in production. 5. It will be a race against time...