Luciano Rodrigues

Diretor de Economia e Inteligência Estratégica da UNICA e Pesquisador do Observatório de Bioeconomia da FGV/EESP

OpAA79

Mercado de carbono e redução de emissões: custo ou oportunidade?

Há anos, a necessidade de redução de emissões de gases de efeito estufa (GEE) tem ganhado notoriedade, direcionando políticas públicas e ações empresariais ao redor do globo. Por um lado, o Acordo de Paris e os compromissos de redução apresentados pelos Países têm demandado uma nova estrutura de governança climática.

Por outro lado, as metas corporativas impostas voluntariamente por várias companhias também indicam a necessidade de mecanismos confiáveis de mitigação e compensação de emissões. É nesse contexto que avançam no Congresso brasileiro iniciativas para a implementação de um sistema nacional de comércio de emissões. Especificamente, a aprovação do PL nº 2148/2015 na Câmara dos Deputados, em dezembro de 2023, trouxe maior notoriedade ao tema, com a proposta de criação do Sistema Brasileiro de Comércio de Emissões de Gases de Efeito Estufa (SBCE).

Em linhas gerais, o mencionado sistema estabelece teto de emissões de GEE para os setores regulados e um mecanismo para o comércio de créditos de carbono. Ao estipular esse limite de emissões, cria-se uma dinâmica em que setores mais poluidores precisam buscar tecnologias e processos menos intensivos em carbono, ou compensar suas emissões com a compra de títulos. O modelo é regido pelo princípio do “poluidor pagador”, visando incentivar e orientar os agentes econômicos e o poder público.

Em linhas gerais, o mencionado sistema estabelece teto de emissões de GEE para os setores regulados e um mecanismo para o comércio de créditos de carbono. Ao estipular esse limite de emissões, cria-se uma dinâmica em que setores mais poluidores precisam buscar tecnologias e processos menos intensivos em carbono, ou compensar suas emissões com a compra de títulos. O modelo é regido pelo princípio do “poluidor pagador”, visando incentivar e orientar os agentes econômicos e o poder público.

Por outro lado, as metas corporativas impostas voluntariamente por várias companhias também indicam a necessidade de mecanismos confiáveis de mitigação e compensação de emissões. É nesse contexto que avançam no Congresso brasileiro iniciativas para a implementação de um sistema nacional de comércio de emissões. Especificamente, a aprovação do PL nº 2148/2015 na Câmara dos Deputados, em dezembro de 2023, trouxe maior notoriedade ao tema, com a proposta de criação do Sistema Brasileiro de Comércio de Emissões de Gases de Efeito Estufa (SBCE).

Em linhas gerais, o mencionado sistema estabelece teto de emissões de GEE para os setores regulados e um mecanismo para o comércio de créditos de carbono. Ao estipular esse limite de emissões, cria-se uma dinâmica em que setores mais poluidores precisam buscar tecnologias e processos menos intensivos em carbono, ou compensar suas emissões com a compra de títulos. O modelo é regido pelo princípio do “poluidor pagador”, visando incentivar e orientar os agentes econômicos e o poder público.

Em linhas gerais, o mencionado sistema estabelece teto de emissões de GEE para os setores regulados e um mecanismo para o comércio de créditos de carbono. Ao estipular esse limite de emissões, cria-se uma dinâmica em que setores mais poluidores precisam buscar tecnologias e processos menos intensivos em carbono, ou compensar suas emissões com a compra de títulos. O modelo é regido pelo princípio do “poluidor pagador”, visando incentivar e orientar os agentes econômicos e o poder público.A regra prevista exige que as empresas, com emissões acima de 10 mil toneladas de dióxido de carbono equivalente (CO2eq.) por ano, deverão implementar sistemática para monitoramento e relato anual da sua condição. Para as companhias dos setores regulados com emissão acima de 25 mil toneladas de CO2eq por ano, adicionalmente à necessidade de monitoramento e relato, haverá a exigência de conciliação periódica das obrigações no mercado regulado de carbono.

Esse mercado será composto por dois títulos: (1) as cotas brasileiras de emissão (CBE), título adquirido por meio de venda ou cessão realizada pelo Estado e (2) os certificados de redução ou remoção verificada de emissões (CRVE). Cada cota ou CRVE representa uma tonelada de dióxido de carbono equivalente (tCO2eq).

O projeto prevê, ainda, a possibilidade de fungibilidade de créditos de carbono emitidos por outras atividades ou programas, em formato similar àquele já implementado em vários mercados mundiais (ETS europeu, sistema de cap-and-trade da Califórnia, entre outros).

Apesar de, nesse momento, a proposta excluir a atividade de produção primária da agropecuária, a política sugerida impõe a participação no SBCE das agroindústrias que ultrapassarem o limite de emissão previsto. Assim, para a indústria sucroenergética, essa iniciativa se coloca como mais um movimento para reforçar a necessidade de ampliar a produção com menor intensidade de carbono.

A oportunidade trazida pela valoração do carbono já é um fato conhecido desde 2020 pelo setor, que participa ativamente da venda

de créditos de descarbonização (CBios). Trata-se de um mercado que movimentou mais de R$ 7 bilhões até o final do último ano e prevê maior emissão de créditos pelas usinas que comercializam biocombustível com pegada de carbono reduzida.

Na mesma linha, o reconhecimento ambiental do biocombustível, também, já é observado como requisito obrigatório para as empresas que exportam etanol para a Califórnia. Esse vínculo entre a menor intensidade de carbono do etanol e o prêmio de preço obtido, também, está presente no programa japonês de uso de ETBE e na regulamentação em curso para a fabricação de combustíveis sustentáveis de aviação (SAF).

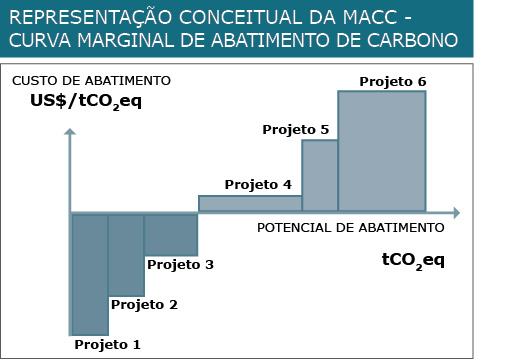

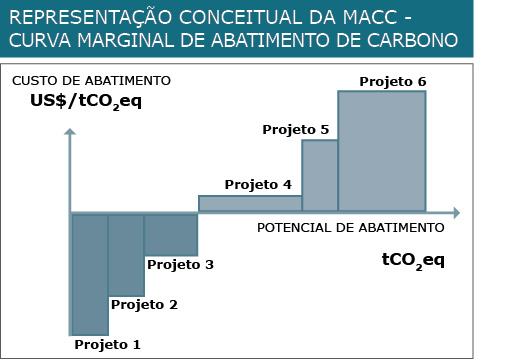

Para as indústrias em geral, a necessidade de redução de emissões é vista como um custo adicional que deve ser minimizado. Essa lógica inclusive deu origem a uma ferramenta conhecida como Curva Marginal de Abatimento de Carbono (MACC na sigla em inglês) no meio empresarial.

Como pode ser visto na figura em destaque, essa curva representa graficamente a relação entre o custo de implementar medidas adicionais para reduzir as emissões de carbono e a quantidade de emissões evitadas como resultado dessas medidas. Em outras palavras, a curva indica quanto uma empresa teria que gastar para reduzir uma unidade adicional de emissão de carbono diante dos vários projetos possíveis.

Na indústria produtora de bioenergia, entretanto, esse conceito parece ser incompleto e deve ser revisitado pelos administradores das companhias. Para quem vende energia renovável, qualquer valoração do carbono deve ser encarada como uma oportunidade de rentabilizar o negócio e não como um esforço de minimização de custos.

Essa mudança aparentemente simples possui implicações transformadoras na dinâmica das empresas. O que era um tema tratado pelas áreas de sustentabilidade, finanças e controladoria diante do custo a ser minimizado na visão tradicional da curva MACC passa a ser direcionado pelas áreas de sustentabilidade e novos negócios como um investimento para obter maior resultado e acessar novos mercados no futuro.

Em outras palavras, para uma indústria que oferta serviço de descarbonização, a precificação do carbono traz novas possibilidades de resultado. A tradicional curva MACC precisa dar lugar a uma curva marginal de lucro associada à menor emissão de GEE. Essa mudança de perspectiva será fundamental para a consolidação da bioenergia tropical no desafio global imposto pela mudança climática.