Martinho Seiiti Ono

Diretor da SCA Etanol do Brasil

OpAA75

Etanol: duas décadas de avanços e recuos

Em 2003, tivemos o lançamento dos carros flex fuel no Brasil, reabrindo nova perspectiva de mercado de etanol hidratado. Todas as montadoras já instaladas, outras marcas europeias e asiáticas chegaram e fizeram vultosos investimentos, lançando dezenas de modelos de automóveis, todos flex fuel, na expectativa de mudança na matriz energética dos veículos leves no Brasil.

Em poucos anos, as vendas de automóveis de ciclo Otto alcançavam 90% dos chamados automóveis flex fuel. Em seguida, as motocicletas também seguiram a tendência, oferecendo muitos modelos que permitiam o uso do etanol E100.

Paralelo a tudo isso, o setor sucroenergético respondeu ao mercado com investimento forte em greenfields, inaugurando mais de 100 usinas em 10 anos. Nossa fronteira limitada somente aos estados de São Paulo, Minas Gerais e Paraná alcançou com força a região Centro-Oeste, com projetos novos, em especial em Mato Grosso do Sul e Goiás.

Paralelo a tudo isso, o setor sucroenergético respondeu ao mercado com investimento forte em greenfields, inaugurando mais de 100 usinas em 10 anos. Nossa fronteira limitada somente aos estados de São Paulo, Minas Gerais e Paraná alcançou com força a região Centro-Oeste, com projetos novos, em especial em Mato Grosso do Sul e Goiás. Assim, a moagem do Centro-Sul saltou de 300 para mais de 600 milhões de toneladas em menos de 10 anos. Além do mercado doméstico, abrimos fronteiras no exterior, elevando nossa participação nos EUA, na Europa e na Ásia. Na virada do século, a euforia por um mundo mais sustentável, com uso de energia renovável no segmento de transporte, fez o setor privado e público se unirem e se comprometerem com a sustentabilidade. Tudo caminhava para futuro, onde a participação do etanol hidratado (E100) seria, ano a ano, crescente, ocupando o espaço do combustível fóssil, a gasolina.

Chegamos a 2012 com mais de uma centena de projetos implantados e consolidados na região Centro-Sul. Em 2012, tivemos a mudança de governo e completa mudança de prioridade. A princesa da vez passou a ser o Pré-sal. Foco total na exploração de petróleo em águas profundas, investimentos e incentivos em energia fóssil voltam à tona. Gasolina, sob o pretexto de segurar a inflação, foi congelada e subsidiada, com preço inferior aos praticados no mercado internacional.

Projetos de biocombustíveis, dezenas deles em fase de maturação, compromissos de amortização em curso começam a trocar de mãos. Projetos que nasceram de famílias tradicionais e empreendedoras, até então o perfil predominante do setor, tiveram que transferir seus ativos aos mais diversos setores da economia. Tradings, fundos de investimentos, distribuidoras, entre outros, socorreram e sucederam muitas usinas.

Importante destacar também o fechamento de dezenas de usinas e destilarias que não suportaram o elevado custo industrial e agrícola, não correspondido pelos preços congelados e subsidiados da gasolina pela Petrobras.

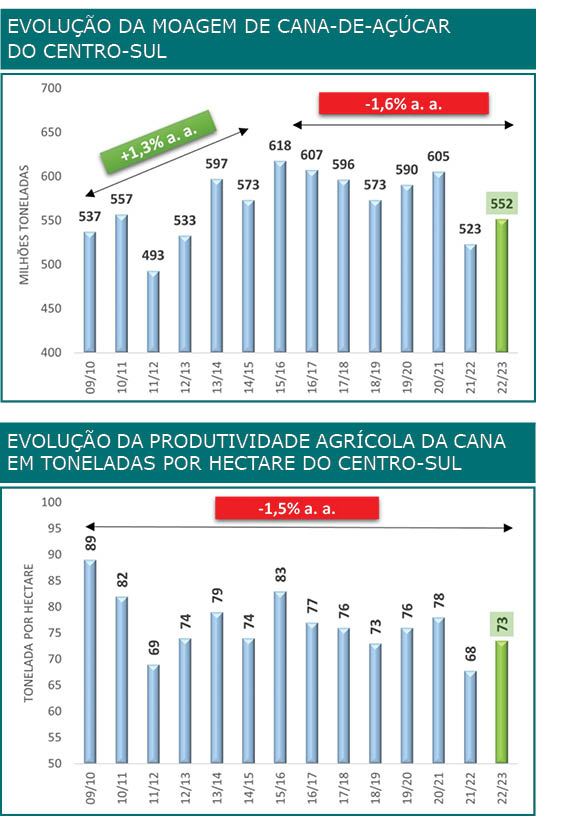

Desde 2013, não tivemos mais “novos projetos” em nosso setor. Paramos por completo de investir. Vejamos os números dos últimos 10 anos.

• Na Safra 2013/14, moemos 600 M de toneladas de cana e, desde então, estamos com crescimento zero, oscilando negativamente, a depender das condições climáticas. (veja detalhes no gráfico: “Evolução da moagem de cana-de-açúcar do Centro-Sul”)

• Nossa quantidade de ATR total se mantém em 80 milhões, com pequenas oscilações.

• Em produtividade (TCH), regredimos, não conseguimos superar 80 toneladas por hectare. (veja detalhes no gráfico: “Evolução da produtividade agrícola da cana-de-açúcar em toneladas por hectare

do Centro-Sul”)

• Área plantada de cana estável, com 7.600 a 7.800 mil hectares.

• A participação do hidratado (E100) no ciclo Otto se altera, a depender do mix maior ou menor de açúcar a cada safra.

• Apenas 5 estados são responsáveis pela

demanda de 85% do etanol hidratado (E100) comercializado no País.

Em 2016, assume o Governo Temer, e, com a chegada de Pedro Parente na presidência da Petrobras, muda o cenário, abrindo novas perspectivas para o mercado de renováveis.

• Preços dos combustíveis no Brasil passam a ser alinhados com preço internacional (PPI), permitindo maior previsibilidade ao setor sucroenergético.

• Incentivo ao uso de biodiesel, com aumento gradativo de mistura.

• Criação e lançamento do programa RenovaBio e comercialização dos CBIOs.

Assistimos nos últimos 5 anos com essa sinalização positiva foi a volta dos investimentos em combustíveis renováveis. Plantas de etanol de milho (greenfields) estão sendo inauguradas e, hoje, já ocupam produção de 15% do etanol total produzido no País. Muitos projetos em construção, assegurando um crescimento de oferta para os próximos anos.

Dezenas de usinas de biodiesel foram inauguradas, distribuídas aos 4 cantos do País, com capacidade instalada de mais de 12 milhões de m3, para um mercado de 6 milhões de m3 em 2022 para mistura de B10. Portanto, com potencial de atender, com tranquilidade, ao mercado com B15, conforme previsto no cronograma pelo CNPE para 2023.

Como sabemos, “Todo investimento depende do ambiente de negócio que vivemos, com políticas públicas economicamente sustentáveis e com a devida segurança jurídica”. Os sinais dados ao setor de combustíveis renováveis no último ano voltaram a ser preocupantes, com mudanças nas regras que estavam estabelecidas, comprometendo resultados das empresas que apostaram investindo no setor, criando novamente uma forte insegurança jurídica.

• A redução de 30% do mercado de biodiesel, com a mistura até então de 13% para 10%;

• Alíquota dos impostos federais (CIDE, Cofins e Pis) sendo zeradas para a gasolina comum e etanol, reduzindo a competitividade do etanol e não reconhecendo as diversas vantagens que o biocombustível proporciona para a saúde, meio ambiente, economia, geração de empregos e desenvolvimento dos municípios brasileiros.

• Os impostos estaduais (ICMS), reduzidos percentualmente e com a PMPF sendo cobrada sobre a média dos últimos 60 meses para a gasolina (preço baixo), enquanto o hidratado (E100), com cobrança sobre o preço real de mercado, o que contribuiu para aumento da perda de competitividade do hidratado.

• O dilatamento do prazo para cumprimento da meta de CBIOs depreciou os preços dos certificados de descarbonização em mais de 50%.

Sabemos que o Brasil apresenta um enorme potencial para o mercado de biocombustíveis. No ciclo Otto, o hidratado (E100) participa com menos de 20% de market share, enquanto a frota de flex fuel é de 83%, carros que poderiam usar etanol hidratado, portanto temos o potencial para crescer, aproximadamente, quatro vezes o atual volume de vendas.

Em óleo diesel − somos importadores de 25% do volume consumido no País −, poderíamos ampliar a mistura e reduzir a dependência externa. Temos terra, clima e, especialmente, tecnologia e uma força de trabalho experiente, com ambição de crescer e investir. Falta o setor público dar a garantia necessária, com política de longo prazo, que assegure confiança e retorno ao empreendedor.

Estamos diante de um novo governo neste ano de 2023, no qual depositamos e almejamos um ambiente de negócios seguro, atendendo aos compromissos que assumimos nas diversas COPs; a meta do RenovaBio de comercializar 47 milhões de metros cúbicos de etanol em 2030, com incentivo para as energias renováveis na transição energética que vivemos.

É preciso corrigir as decisões equivocadas, tomadas ao calor das últimas eleições, para tranquilizar e assegurar ao setor privado confiança na manutenção e ampliação dos investimentos necessários para atender ao enorme potencial existente no segmento de combustíveis renováveis.